Over the last decade, Bangladesh’s economy has successfully maintained a trajectory of rapid economic growth and development. Despite this progress, the issue of debt servicing has gradually emerged as a subject of concern. As the country undertakes multiple mega projects and social development initiatives, its debt obligations have increased, leading to heightened discussions about the implications and potential solutions of these financial commitments.

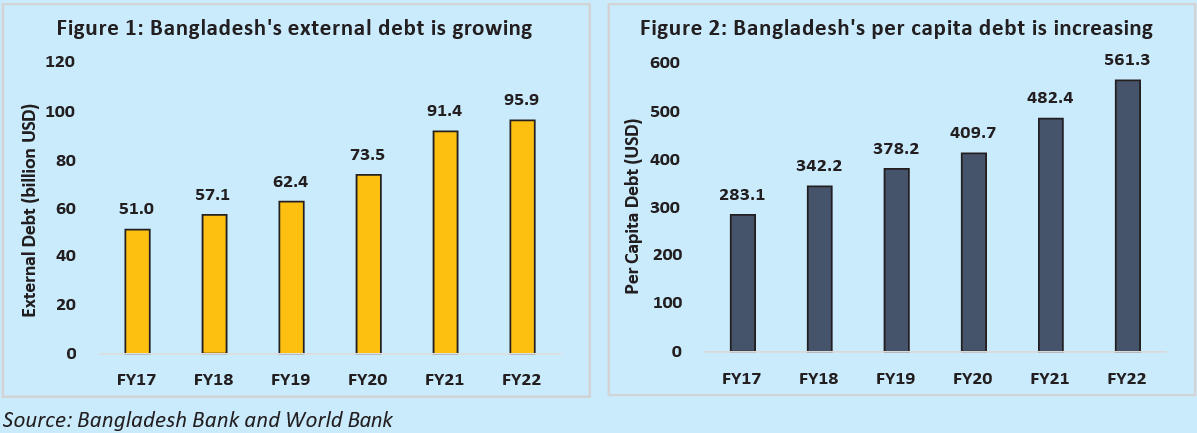

Over a span of just six years, Bangladesh’s external debt has nearly doubled, crossing to USD 95 billion, a significant increase from USD 51.0 billion in FY17 (Figure 1). Correspondingly, during this same timeframe, the per capita debt has risen from USD283.1 billion to USD 561.3 billion, based on data from the Bangladesh Bank (Figure 2).

As outlined in the World Bank’s International Debt Report for 2022, Bangladesh’s external debt composition in 2021, categorized by debtor type, comprises long-term debt, short-term debt, and IMF credit. Notably, long-term debt accounts for 76%, followed by short-term debt at 20%, and IMF credit at 4%. In 2021, the nation’s long-term external debt escalated to USD 70.0 billion, marking a significant increase from USD 38.7 billion in 2017. Among these, the public sector’s share stands at 90%. Moreover, IMF credit and Special Drawing Rights (SDR) allocation combined to total USD 3.3 billion in 2021, a rise from the USD 2.1 billion reported in 2020. Concurrently, short-term external debt experienced a substantial 65% surge, reaching USD 18.1 billion by the close of 2021, compared to the USD 11.0 billion recorded the previous year. The repayment of long-term principal has undergone a notable increase of 36%, amounting to USD 4.2 billion in 2021 compared to USD 1.5 billion in 2017. During the same period, long-term interest payments have seen a substantial surge of 51%, rising from USD 553 million to USD 1,088 million.

The report also outlines key indicators aimed at comprehending the nation’s external debt scenario. For instance, the external debt-to-export ratio exhibited a rise to 184% in 2021, a notable increase from 130% recorded in 2017. Similarly, the external debt-to-GNI ratio witnessed an uptick to 21% in 2021, compared to 17% in 2017. The external debt service-to-export ratio surged to 11% in 2021, a significant climb from 5% in 2017. Conversely, the reserves-to-external-debt ratio saw a decline to 50% in 2021, down from 64% registered in 2017. Under these circumstances, the issue of debt servicing is anticipated to pose a concern for the country in the coming years.

One of the primary contributors to the increasing concern about debt servicing in Bangladesh is its reliance on borrowing to finance various development projects and initiatives. Bangladesh’s situation is made worse by a number of factors. First, the country’s ambitious development agenda demands considerable financial resources. The government is investing in infrastructure, education, healthcare, and other vital sectors to improve the quality of life for its citizens. While these investments are crucial, they often require external funding, resulting in an increased national debt. Second, the terms of borrowing are crucial in determining its impact on debt service. Loans with unfavourable conditions, such as high-interest rates or short repayment periods, can strain the country’s financial resources. The second factor contributing to Bangladesh’s debt servicing concern is revenue generation. Bangla- desh’s fiscal policy is characterized by a notable deficiency in tax efforts, as evidenced by its declining revenue-to-GDP ratio. In recent years, this effort has dwindled to below 10% of the GDP, positioning Bangladesh with the lowest tax effort globally. This percentage falls short of even half of that 25% in emerging and developing Asian economies. It is also far less than that of Nepal (22%), India (20%), and Pakistan (15%) among others. The informal sector, which constitutes a substantial portion of the economy, often escapes the tax net. This places a heavier burden on the formal sector and reduces the overall revenue collected by the government.

It is, therefore, crucial to address the growing concern of external debt servicing in Bangladesh. It requires a multi-faceted approach that tackles both the borrowing and revenue fronts. First, borrowing decisions should be prudent. The government should prioritize obtaining loans with favourable terms, including reasonable interest rates and longer repayment periods. A comprehensive assessment of the country’s borrowing capacity and needs should guide borrowing decisions to prevent over-extension. Second, the revenue streams need to be diversified. To improve revenue generation, Bangla- desh needs to broaden its tax base. Efforts should be made to integrate informal economic activities into the formal sector, thereby increasing tax revenues received. This can be achieved through incentives, simplified tax structures, and better enforcement mechanisms.

RECENT COMMENTS