Trade logistics is often considered a fundamental building block of trade and economic development. The term trade logistics usually encompasses a cluster of vital activities for trade including transportation, warehousing, cargo consolidation, border management, customs capacity, distribution, and payment mechanisms. Facilitating such activities aims to reduce the cost of trading throughout the supply chain, thereby enhancing overall competitiveness in trade.

Trade logistics facilitation enhances countries’ competitiveness by making on-time trading of goods and services with lower transaction costs. On the other hand, poor logistics can become a foremost obstacle to trade. This is because poor logistics make it difficult for countries to tap new market opportunities as well as improve their overall competitiveness in the trading system. Therefore, analysis of the performance of trade logistics has significant policy implications.

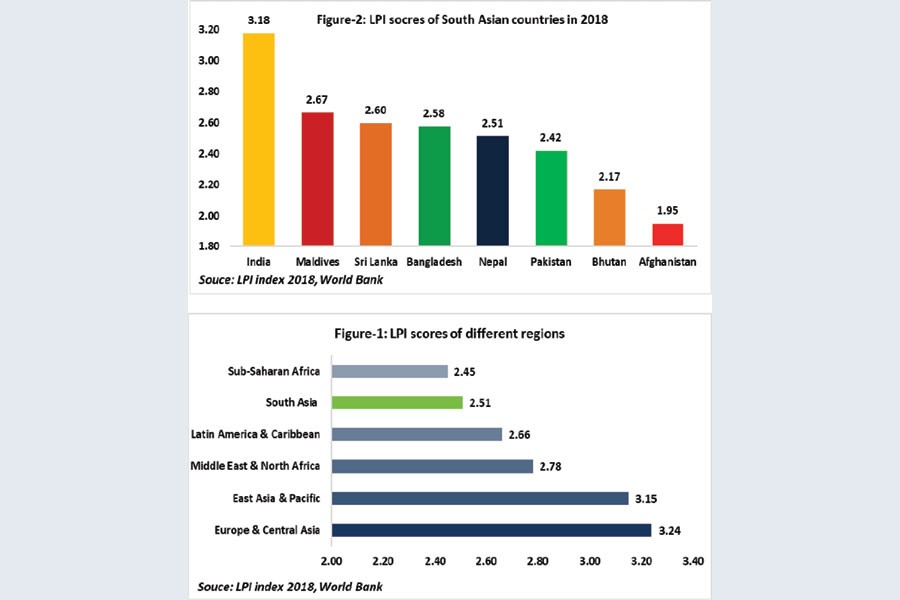

To understand the performance of South Asia in terms of trade logistics, it is pertinent to compare its international Logistics Performance Index (LPI) with those of other regions. LPI is published by the World Bank that measures performance along logistics supply chain across countries. From Figure 1, it can be seen that the LPI score of South Asia was the second-lowest in 2018 compared with those of other regions. The LPI sore of South Asia was 2.51 in 2018 which 2016 was higher at 2.62. On the other hand, the lowest LPI score came from Sub-Saharan Africa during the period with 2.45 and the highest LPI score in Europe and Central Asia at 3.24. Compared with the average LPI score of low-income countries (2.40), South Asia dud slightly better in 2018. However, the LPI score of South Asia is considerably lower than the average LPI scores of lower middle income (2.60) and upper-middle-income countries (2.70).

In terms of individual countries, India is the best performer (Figure 2) within the South Asian region scoring 3.18 (44th). LPI scores of Maldives, Sri Lanka, Bangladesh, Nepal, Pakistan, Bhutan, and Afghanistan are 2.67 (86th), 2.58 (100th), 2.51 (114th), 2.42 (122nd), 2.17 (149th) and 1.95 (160th) respectively in 2018. According to the findings of the LPI report (2018), countries can be classified into four categories depending on their LPI scores. These four categories are logistics unfriendly (bottom quantile), partial performers (third and fourth quantile), consistent performers (second quantile) and Logistic friendly (top quantile). In the South Asian region, no country belongs to the top quantile. India is the only consistent performer in this group, followed by five partial performers (Maldives, Sri Lanka, Bangladesh, Nepal, and Pakistan). Lastly, Bhutan and Afghanistan are considered logistic-unfriendly countries.

Bangladesh’s logistics performance is not at all satisfactory. In the 2010 LPI report, the country attained 2nd position in the South Asian region but slipped to 4th in 2018 from 3rd in 2017. The logistics performance of the country can also be seen through broad indicators. The LPI report of 2018 shows that the country scored the lowest on customs (2.30) and infrastructure (2.39) than the rest. The score relating to customs went down by 0.27 percentage points to 2.30 from the previous 2.57. Correspondingly, the score of infrastructure slipped by 0.10 percentage points to 2.48 from the past 2.39. But the score compared to 2016 has somewhat improved in terms of tracking-tracing and timeliness indicators.

From the broad indicators of LPI, it can be seen that South Asian countries have also low scores on customs (2.32) and infrastructure (2.33) than the rest of the world. A poor score on customs can be explained by inefficient customs procedures. It has been seen that physical inspections, repeated inspections by multiple agencies and excessive opaque procedural requirements delay the custom services in South Asian counties. On the other hand, there are infrastructural gaps, especially with respect to transportation due to inadequate roads and rail connectivity, relatively high cost of transport services and lack of maintenance investments.

Bangladesh also finds poor customs and inadequate infrastructure as the key barriers to improve its trade logistics performance. Besides, unskilled workforce, congested transportation, delay of shipments are the major bottlenecks that lead to high cost on the country’s economy. In addition to physical infrastructures, it is also vital to improve the quality of the Information and Communication Technology (ICT) system to ensure timeliness as well as tracking and tracing activities. It is worth mentioning that skills improvement can act as a catalyst for increasing logistics performance.

Lastly, to implement policies to focus on improving trade logistics performance, it is immensely important to have seamless collaboration among all the stakeholders.

RECENT COMMENTS