The analysis of comparative advantage is important from the policy perspective. Trade policies of a country should be tuned to promote export items where the country has a comparative advantage. The Revealed Comparative Advantage (RCA) analysis, suggested by Bela Balassa in 1965, is an ex-post analysis of comparative advantage and has been used in many studies. RCA index is used to calculate the relative advantage, disadvantage, and trade potential of a certain product in a country.

The RCA index is measured as the ratio of a product’s share in the country’s total export relative to its share in the world’s total export. The formula for the RCA is equal to (Xij/Xit)/(Xwj/Xwt) where, Xij and Xwj are country i’s export and world export of product j respectively, while Xit and Xwt are country i’s total export and world total export respectively. If RCA is greater than unity, the country is said to have a comparative advantage in that product; and if RCA is less than unity, the country has a comparative disadvantage in that product. The RCA index is popular because of its simplicity, availability of data and for cross-country comparisons. The index is consistent with the country’s factor endowment and productivity.

In this article, we are interested to know in which products Bangladesh has a comparative advantage and the dynamic changes of its comparative advantage. We have calculated RCA at the 6-digit level of the harmonized system (HS) of classification for the periods between 2001 and 2013. RCA indices for Bangladesh are calculated using the data of export volumes of Bangladesh and the world from the Trade Map database. 4

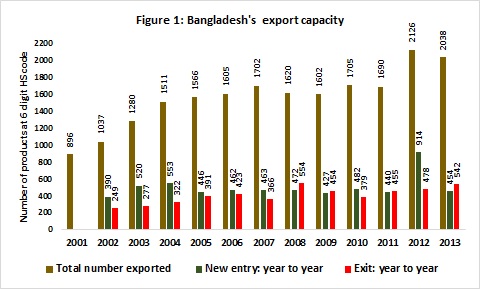

Before going into the RCA analysis, let’s first explore how many products Bangladesh exports. At the 6-digit HS code level, there are approximately 5300 products. Figure 1 shows that in 2001, Bangladesh exported 896 products, which, by 2013, increased to a number of 2038. In 2012, Bangladesh exported 2126 products which were the highest among the years under consideration. This suggests that, not only in terms of volume but also in terms of a number of products, Bangladesh’s export capacity increased by more than double during 2001 and 2013. On a year-to-year basis, some new products were added to the export basket and some were ceased to be exported. However, there were 375 common products which Bangladesh exported all the years under consideration.

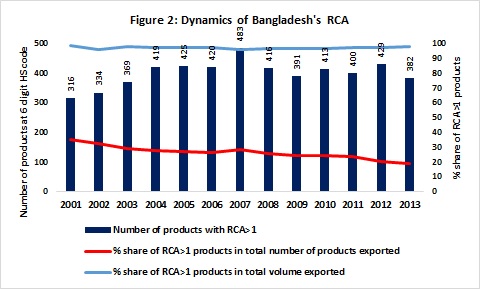

Figure 2 presents the numbers of products at 6-digit HS code where Bangladesh had a comparative advantage during 2001 and 2013. In 2001, the number of products with RCA>1 was 316, which, with some year-to-year fluctuations, increased to 382 by 2013. The highest number of RCA>1 was observed in 2007 consisting of 483 products. Figure 2 also suggests that the percentage share of RCA>1 products in the total number of products declined over time: from 35% in 2001 to 19% in 2013. However, as a percentage of total exports, throughout those years, Bangladesh enjoyed a comparative advantage in more than 97% of its total export. Furthermore, over those years, the comparative advantage had been consistent for 130 products at the 6-digit level among which 115 products were from readymade garment industries. All these suggest that although Bangladesh was able to expand its export basket during 2001 and 2013, the number of products it had comparative advantage didn’t increase proportionately, which indicates escalated concentration of RCA in certain products.

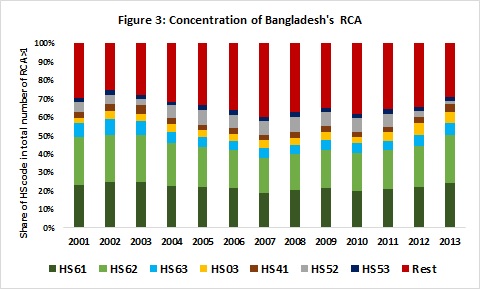

The escalated concentration of RCA in certain products during the period under consideration is manifested by the fact that Bangladesh’s RCAs had been concentrated around the products in the HS codes 03 (fish and shrimp), 41 (raw hides and skins and leather), 52 (cotton yarn), 53 (raw jute), 61 (knitted readymade garments), 62 (woven readymade garments) and 63 (home textile and jute hessian bags). However, a close look at Figure 3 suggests that Bangladesh’s comparative advantage has been highly concentrated around the readymade garments sector. In 2013, a number of products with RCA>1 under the HS codes 61, 62 and 63 accounted for 57% of the total number of products with RCA>1. In 2007, such a number was 43%. It should also be mentioned here that, readymade garments account for more than 80% of the total export earnings of Bangladesh in recent years.

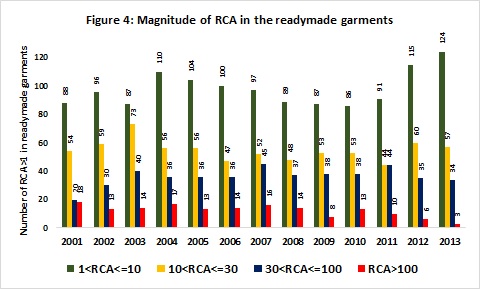

Although RCA had been concentrated around the readymade garments sector, the average value of RCA declined. The maximum value of RCA in the readymade garments was 495 in 2001, which declined to 184 by 2013. Bangladesh had also been losing the very high comparative advantage it had in garments exports. Figure 4 suggests that, in 2001, Bangladesh enjoyed very high RCA (RCA>100) in 18 garments products, which declined to only 3 in 2013. In contrast, the number of products with RCA less than or equal to 30 increased over time: from 142 in 2001 to 181 in 2013.

A similar analysis, with respect to the leather and leather goods, suggests that there had not been many variations in the number of products having RCA in this sector. And, as in the readymade garments sector, Bangladesh had been losing the very high comparative advantage it had in this sector. In contrast, Bangladesh had been enjoying consistently very high comparative advantage in jute and jute products, where, in all of 6 products, RCA ranged between 53 and 1068.

The aforementioned analysis shows that during the period under consideration, Bangladesh’s comparative advantage had been concentrated around low-skilled labor-intensive readymade garments exports. However, in recent years, compared to the early 2000s, there had been some products where Bangladesh gained a comparative advantage. These include edible fruits, animal and vegetable fats and oil, preparations of cereals, flour, starch or milk, and pastry cooks’ products, preparation of vegetables, fruits, nuts, residues from food industries, rubber and rubber products, copper and copper products, and furniture. However, Bangladesh lost comparative advantage in fertilizers, the printing industry’s products, articles of iron and steel, and miscellaneous manufactured articles.

Finally, we are interested to know how tariff rates, both at home and partner country, affect Bangladesh’s revealed comparative advantage at the sectoral level. For this exercise, we have constructed panel data at the 6-digit HS code level for the period between 2001 and 2013. The dependent variable is the RCA which is a binary variable, where it takes a value of 1 if RCA is greater than unity and zero otherwise. The first explanatory variable is the domestic tariff rate at the 6-digit HS code level, which is the effectively applied tariff rate and its data is taken from the WITS database. The second explanatory variable is the partner country’s tariff rate, which is calculated as the weighted average of simple tariff rates imposed by top export destination partners of Bangladesh namely the USA, EU, Canada, and India. Data of partner countries’ tariff rates are taken from the WITS and OECD-WTO database. The fixed effect panel logit regression results suggest that the domestic tariff rate is negatively associated with RCA and the coefficient is statistically significant. This suggests that a cut in domestic tariff raises the likelihood of RCA greater than unity among the sectors. In contrast, the coefficient of the partner countries’ weighted tariff rate is not statistically significant. The reason behind the non-association between the RCA and partner countries’ tariff rate could be because of the fact that the large part of Bangladesh’s export to its major partner countries is under different preferences schemes; for example, Bangladesh’s exports enjoy the duty-free and quota-free market access in the EU market.

RECENT COMMENTS