Context:

Bangladesh is at a crossroad after the student led movement. The expectations from the current interim government are huge pointing to bold and radical reforms in various fronts including economic front. Key economic challenges facing the interim government are taming inflation, arresting foreign reserve depletion trends, restoring discipline and people’s trust in the banking system, and revamping revenue mobilisation system. Revenue efforts (i.e. revenue generated from the national income or GDP – which is defined as revenue to GDP ratio) have historical been low in Bangladesh. The outcome of the low revenue efforts has been constraining public expenditure (i.e. expenditures by the government). In particular, low revenue effort has severely constrained the ability of the Bangladesh government to finance important expenditure on physical infrastructure, human development and pro-poor spending. Low revenue effort has restrained the ability of the government to improve the infrastructure which is limiting economic growth and employment. It has also put a strain on the government’s ability to fund programmes that provide benefits to the poor such as including health, education, water supply and safety net programmes. Thus, raising more revenue or improving revenue effort is of paramount importance to any government but more so on the interim government since the expectations of meaningful positive changes are enormous.

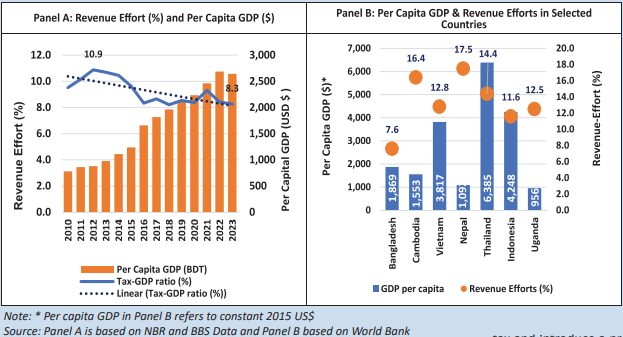

Generally, there is a positive relationship between expansion of income (i.e. GDP, per capita GDP) and revenue mobilisation in a country. In Panel A of the above figure, revenue efforts are contrasted against per capita GDP. The trend in per capita GDP is increasing – suggesting that the incomes (or broader tax base) are rising – leading to more revenue generation (even when the tax rates remain the same). Contrary to this association, the falling revenue-effort trend point to an inefficient revenue system in Bangladesh. Revenue efforts which were around 11 per cent in 2011 declined to 8.3 per cent in 2023 – implying a 2.7 percentage point drop over the 12-year period when per capita GDP increased by about 200 per cent. Such a large negative association between per capita income increase and revenue efforts is unacceptable and untenable.

Furthermore, Bangladesh’s performance in mobilising revenue is pathetic when compared to her peer countries. With less per capita GDP compared to Bangladesh, both Nepal and Cambodia have scored significantly high on revenue efforts (i.e. their revenue efforts were more than double of our revenue efforts of 7.4%) than Bangladesh. Even Uganda with half of Bangladesh’s per capita GDP has been able to raise 12.5 percent revenue – 5.1 percentage points higher than the revenue efforts of Bangladesh. These comparative measures again points to the inefficiency of the Bangladesh’s revenue system.

Another striking feature of our tax system is the inability to raise higher proportion of the tax revenue from the direct tax system. The current system of taxes is based on the antiquated income tax ordinance from 1984, which causes the system to fall further and further behind the times. The income tax forms are complex and filing requirements frighten many voluntary compliances, as tax filers are scared of facing harassment from NBR. As a result, there were only 2.5 million taxpayers, which was 1.52 per cent of the total population in FY22. As a result of low compliance and tax net of income tax revenue from direct tax has been low and reliance on indirect tax us high. As a result, Bangladesh has been mobilising around 70 per cent her taxes from the indirect tax system – epitomizing a regressive tax system where poorer are paying more taxes from their income compared to the relatively well-off segment of the population.

The above assessments suggest that the revenue system in Bangladesh is highly inefficient and as well inequitable. The reason for the dismal state of revenue system is that no meaningful reforms were implemented during the last three decades after the implementation of the 1991 VAT system replacing the sales tax. Thus, future revenue reforms must focus on both the efficiency and equity aspects. Moreover, it is important to roadmap of reform with clear earmark targets. Bangladesh should aim to raise her revenue effort to 13.5 per cent within next two years and 16.5 per cent within next five years. Although these targets may appear very optimistic, but performances of other countries point to their feasibility. At the same time, revenue mobilised from the direct tax system must increase to 40 per cent in the next two years and to 60 per cent within the next five years.

Strategic Recommendations:

- Full adoption and effective implementation of the original VAT and Supplementary Duty Act 2012. The implementation of the 2012 VAT law is likely to improve VAT revenue mobilisation, address the inefficiencies of VAT system and help enhance overall revenue mobilisation.

- Incorporate Alternative Dispute Resolution (ADR) in Income Tax, VAT and Custom Acts for realisation of unpaid revenue.

- Vastly simplify the personal income tax system by eliminating wealth and income-expenditure statements, which is an important source of corruption. Take necessary steps to ensure electronic filing and payments and also remove all direct interface between taxpayer and tax collector. These measures are expected to improve voluntary compliance and expand the tax base even to the rural areas where digital technology is making progress.

- Revamp the corporate tax regime by lowering corporate rates to a maximum of 25 percent over the medium term with few exceptions. It is time to eliminate most tax exemptions. With respect to the corporate tax system, all sectors should be treated equally including the readymade garments (RMG) sector.

- Bangladesh needs a modern audit system. This should be a computer-based system that identifies audit candidates using a scoring method based on pre-determined red flags. Generally, these red flags should be designed to be revenue productive and target genuine tax evaders. This should be very selective and productive in terms of revenue yield.

- Eliminate the wealth tax and introduce a proper system of property tax based on a realistic valuation of personal and commercial properties and a meaningful tax rate with revenues earmarked for local governments.

- Adoption and implementation of the new Customs Act in FY2022.

- Currently NBR has been entrusted with both of tasks of tax planning and tax collection. Since the outcomes are unsatisfactory, it is imperative to separate tax planning from tax collection. At the it is important to strengthen the research and administrative capacities of the NBR through international technical assistance and partnership with local research institutions. To facilitate research and planning, all tax data should be computerized. Online tax filing will facilitate this process.

This Article was first published in the September, 2024 edition of the Thinking Aloud.

RECENT COMMENTS