International remittances play a crucial role in the economic growth and poverty reduction in Bangladesh. These remittances are sent by Bangladeshi migrant workers especially in the Middle-Eastern countries, US, UK, European countries, and East Asian countries. Bangladesh is the seventh highest remittance-earning country in the world. A reasonably high growth in remittance inflows over the last one decade, until the recent macroeconomic crisis, has been instrumental in maintaining a stable current account balance, despite the fact that the trade deficit has increased over the years. This in turn has helped Bangladesh to maintain a growing level of foreign exchange reserves until the end of 2021.

International remittances come to Bangladesh through both the formal and informal channels. The formal channels involve formal banking and other money transferring processes. Remittances inflow through the formal channels help the government secure foreign currencies, which is critical for macroeconomic stability. However, there are concerns that a sizeable amount of the international remittances doesn’t come through formal channels, but through informal channels under hundi.

The hundi business is an informal way of transferring money from one country to another. It is illegal in Bangladesh and works outside the conventional banking system. It is basically a verbal agreement that assures the transfer of money. Though informal, the hundi business is well-organised. It is used as bills of exchange in trade transactions, as credit instruments for borrowing money, and as remittance instruments for transferring money from one place to another. In the major labour-receiving countries of the Middle East and East and Southeast Asia, the hundi business is used by migrant workers from South Asia in general and from Bangladesh in particular.

The hundi business is a critical factor in contracting the prospect of the inflow of remittance in foreign currencies through official channels. In Bangladesh’s case, there are concerns that over the last one year, despite a large number of Bangladeshis going abroad to work in foreign lands, a significant part of the remittances sent have not come through official channels. In this process, the country is losing the inflow of precious foreign currencies amid the ongoing forex crisis. Anomalies of exchange rates in Bangladesh as well as the high transaction costs and formalities for sending remittances through formal channels have been highlighted as the major reasons behind the popularity of informal channels among the Bangladeshi expatriates sending remittances.

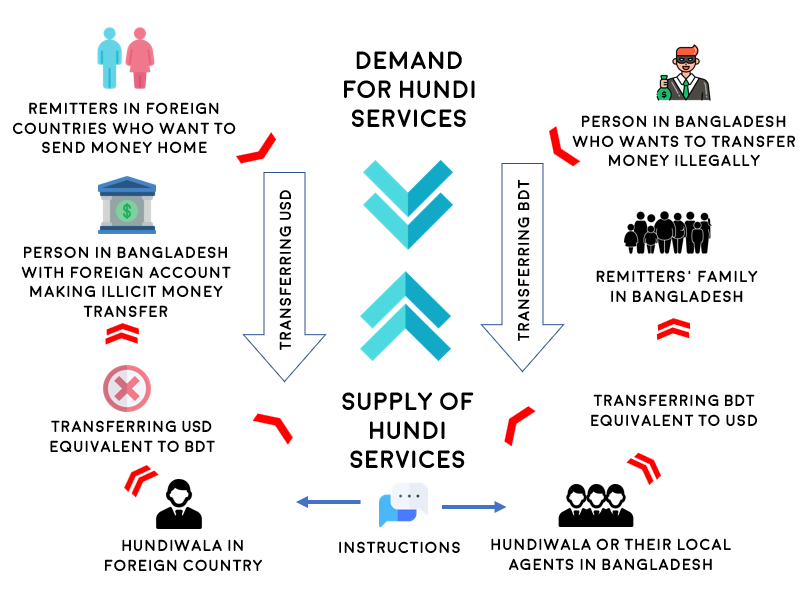

However, there are some linear or one-sided explanations regarding the hundi business in Bangladesh. A more comprehensive analysis is needed to gather a complete picture. There are both demand- and supply-side dynamics of the hundi business, and conventional thinking misses out on some critical elements in these dynamics.

Conventional thinking dictates that the remitters abroad are the ones who demand the services offered by the hundi business. In the same way, it is generally thought that the supply of this business is managed by the “hundiwala” (hundi service providers) abroad and their domestic network of local agents. The remitters hand their hard-earned foreign currency (let’s assume it’s US dollars for the convenience of analysis) to the hundiwala abroad, who then direct their agents or other hundiwala operating in Bangladesh to pay the remitter’s family the equivalent amount in Bangladeshi taka. Thus, the US dollar is not flowing into the country; instead, it is remaining in the foreign market.

The above-mentioned explanation provides an incomplete picture of the whole system. It fails to explain what the utility of the collected US dollar is to the hundiwala abroad. In order to build a complete picture of this system, we need to introduce another actor in Bangladesh: individuals or groups who want to syphon off their illicit money abroad. In this regard, the individual or groups in question pay the amount of illicit money in taka to the local hundiwala or their agents, and in exchange, the hundiwala abroad deposits an equivalent amount of money in US dollars in designated accounts of those individuals or groups. The taka collected by the local hundiwala from the money launderers is used to pay the families of the remitters in Bangladesh in exchange for the US dollar collected from those remitters in foreign countries.

The interesting aspect of this whole scheme is that we can see two separate trades: one in the US dollar abroad, and the other in the taka in Bangladesh, without any exchanges between these two.

It is not only that the remitters are sending money home through the hundi business, but there is also a strong demand in Bangladesh for these services among those who are engaged in illicit money transfers. And in order to meet this demand, the hundi service providers are collecting foreign currencies from the remitters.

Illicit transfer of money has become a matter of serious concern for the economy and society in Bangladesh. It is also responsible for low domestic resource mobilisation in Bangladesh. If hundi is to be done away with, along with correcting the anomalies of exchange rates and lowering the transaction costs and formalities, the local demand for illicit transfer of money has to be dealt with. If illicit money transfers cannot be restricted, hundi service providers will always be active – they will continue to persuade the remitters, if required with highly lucrative exchange offers, regardless of whatever action the state takes with regard to the exchange rate. This area needs to be addressed urgently, and there needs to be strong political will to do so.

The article was first published in the Daily Star, on 2 March 2022

RECENT COMMENTS