Selim Raihan, Nafiz Ifteakhar, and Mir Tanzim Nur Angkur

For long, empirical studies on the role of exports in promoting growth in general, and productivity in particular, used data at the country or industry level to test whether exports promote productivity growth or vice versa. However, a series of empirical studies since the early 1990s started using firm-level data to look at differences between exporters and non-exporters in various dimensions of firm performance, including productivity.

Two alternative but not mutually exclusive hypotheses can be mentioned why exporting firms can be expected to be more productive than non-exporting firms. The first one relates to the fact that firms that are considered to be more productive than others are likely to participate in export markets – the so-called ‘self-selection’ of the more productive firms into export markets. The second one relates to the notion of ‘learning by exporting’ hypothesis which suggests that after entering the export market, firms are able to acquire new knowledge and adopt new expertise which eventually leads to higher level of productivity. Though there is sizeable evidence that exporters perform better than non-exporters, the issue of the direction of the causality between exports and productivity is still debated. While in the contexts of more advanced countries most studies find evidence that the export premium is due to a self-selection process, a number of recent studies on less developed countries tend to endorse the learning effect.

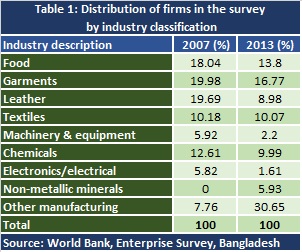

Against this backdrop, this paper explores how export orientation affects firm-level productivity by looking at the range of determinants of productivity of manufacturing firms in Bangladesh. A review of empirical studies suggests that there could be several factors, i.e. firm size, firm age, the share of firm’s output in the industry, export orientation measured as a percentage of total firm’s output that is exported, which may affect firm’s productivity. Our measure of a firm’s productivity is the total factor productivity (TFP) which is derived using the Cobb-Douglas production function framework. Specifically, we have regressed log of output (calculated as total sales of firms) on log of capital (measured as netbook value of fixed assets of the firms) and log of labor (measured as a total number of employees) to get the output elasticity of capital and labor which are then used to estimate the total factor productivity (TFP). To get unbiased estimates of those elasticities in the presence of industry fixed effects, we have included industry dummies in the above regression. We have used the dataset of “The World Bank, Enterprise Survey-Bangladesh” for 2007 and 2013 and have only considered firms belonging to the manufacturing sector. Table 1 shows the industry descriptions along with the distribution of firms for both 2007 and 2013. We have estimated TFPs of firms separately for 2007 and 2013 by following the same procedure described above.

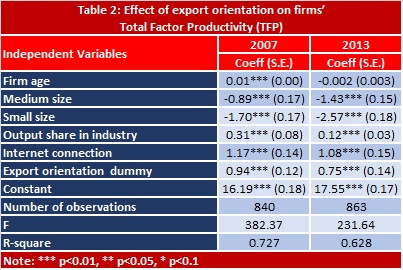

In order to explore the effect of export orientation on the productivity of firms, we have run cross-section regressions for 2007 and 2013. For both years we used the same model and Table 2 shows the estimated results. The dependent variable of our model is the total factor productivity. The main explanatory variable is the export orientation while the set of control variables include firm size, firm age, firms’ output share, and internet connection. In the regression models, the export orientation of the firm is represented by a dummy variable, where the dummy variable takes the value of 1 if the firm exports 25% or more of its total output.

For firm size, we have also taken three dummies- large, medium and small based on the number of employees. For capturing the effect of technology on productivity, we have taken the internet connection dummy. Internet connection dummy will take the value of 1 if the firm communicates by e-mail.

The cross-section regression result of 2007 suggests that firm age has a positive and significant effect on productivity, while the result of 2013 indicates no such relationship. For 2007, it is estimated that an increase in firm age by one year would lead to a rise in productivity by 1%. For both years, firm size has an effect on productivity. In particular, both medium and small-sized firms tend to be less productive than large firms. The firm’s output share is found to have a positive and significant effect on productivity for both 2007 and 2013 respectively. For 2007, one percentage point increase in a firm’s output share would lead to a rise in the firm’s productivity by 31%, while for 2013 such productivity rise would be by 12%. Now considering the effect of internet connection on productivity, firms with internet connections are found to be more productive than firms with no internet connection for both 2007 and 2013.

Our variable of interest is the export orientation which is found to have a positive and significant effect on productivity for 2007 and 2013. For 2007, we have found that on average productivity of a firm that exported 25% or more of its output was 156% higher than a firm that exported less than 25% of its total output. Such productivity difference was however reduced in 2013, as productivity of a firm that exported 25% or more of its output was 112% higher than a firm that exported less than 25% of its total output.

From the aforementioned analysis, it can be said that larger firms are more productive as compared to small and medium-sized firms. Larger firms, due to economies of scale, are able to reap some benefits which help them to utilize resources more efficiently. Firms that started earlier in an industry also tend to be more productive than firms that entered the industry later. This is due to the fact that already established firms have advantages over new firms in case of production, marketing, etc.

Also, the output share of the firm belonging to an industry (measured by the proportion of sales of firms in total industry sales) may influence the firm’s productivity. Firms with higher output share can positively affect productivity, as dominant firms hold the necessary resources and technical skill and expertise as compared to firms with low output share. It is also found that firms which have access to internet connections can benefit from lower communication cost and can also communicate with their clients and suppliers timely and thus leads to higher productivity.

Finally, the regression results confirmed that the exporting firms in Bangladesh are more productive than their counterparts. There could be several reasons for this. The learning process may work through technical supports from external buyers, and/or through the exposure to competition in the international markets, which can result in knowledge, technology, and efficiency gain from exporting.

RECENT COMMENTS